Zhongnv Era (women aged 35 years and above): How China’s Mature Women Are Redefining Health, Emotional Value, and Household Decisions

- See Qian

- Jan 16

- 4 min read

A consumer force hiding in plain sight

Source: PCG LAB

China’s female consumer market is not a niche, it is a national engine. The report estimates nearly 400 million women aged 20 to 60, controlling around RMB 10 trillion in annual consumption spend. Their influence is shifting commercial storytelling towards female priorities across categories once designed for men.

Source: PCG LAB

Within that bigger story, women aged 35 years and above stand out because they spend with clearer logic. Their choices are increasingly tied to risk management, self-care, identity, and emotional stability. In the May 2025 sample, women aged 35 to 55 account for 60% of respondents, showing how central this cohort is to the report’s findings.

The life agenda shift: from “more” to “better”

Across age groups, the top life issue is health management (67.3%), followed by mental health (60.4%), making wellbeing a year round consumption anchor rather than a seasonal trend.

Priorities also evolve by life stage: 18 to 25 most focus on self-growth (69.0%); 26 to 35 on career development (65.5%); 36 to 45 and 46 to 55 on children’s education (72.7% and 69.3%); and 56 and above on health management (68.0%). The report frames these agendas through “Wo, Ni, Ta”, linking self-improvement, relationship and family needs, and wider social participation.

What this means for brands: the strongest message is not indulgence, but support. Help her stay capable, calm, and in control.

Emotional value becomes the decision trigger

Mature women are rational, but emotion led. In the report, 62.8% say emotional satisfaction is their first consideration when consuming, and this grows stronger with age.

This changes how value is built: functionality is expected, credibility is the filter, and emotional comfort closes the decision. Emotional satisfaction often means reduced anxiety, professional reassurance, and a feeling of being respected rather than sold to.

What this means for brands: emotional value must be engineered through service design, privacy, education, tone of voice, and community, not just claimed in advertising.

Health becomes the master category, and FemTech accelerates

Health is the organising principle of consumption, reinforced by demographics. The report highlights around 157 million women aged 45 to 59 in menopause related life stages, driving demand around sleep, mood, weight management, stress regulation, and preventative care.

Technology is accelerating this shift. The report notes the global FemTech market reached US$39.29 billion in 2024 and is projected to approach US$100 billion by 2030, enabled by AI driven personalisation and data based health guidance.

What this means for brands: credibility is everything. Education, validation, and responsible claims are growth drivers, especially in health adjacent categories.

Beauty is not vanity, it is governance

The report positions beauty and aesthetic spending as self-management, particularly via light medical beauty. Women aged 35 years and above account for 47% of light medical beauty consumers, with annual spending growth exceeding 20%. Women aged 40 years and above account for 10% of medical beauty consumers, and the share is rising.

The underlying logic is control and confidence, not reinvention. Beauty services deliver visible reassurance, which links directly to emotion led rationality.

What this means for brands: compete on professionalism, privacy, reassurance, and aftercare, not just product claims.

She holds the household, and increasingly, the plan

The report states that in mainland China, 80.6% of household consumption decisions are led by women. The survey reinforces this leadership: 93.5% say they primarily control their own income, and 81.5% say they are the main decision maker for household consumption.

Planning behaviours are strong: 72.1% have participated in retirement or long term care planning. The report also notes women’s average personal savings are higher than men’s by 7%, and 73% of Chinese women are actively engaged in financial planning. Among partnered respondents, 76% of women manage household finances (vs 66% for men). On children’s education, mothers hold 54.9% of decision making power in quality education contexts.

Source: PCG LAB

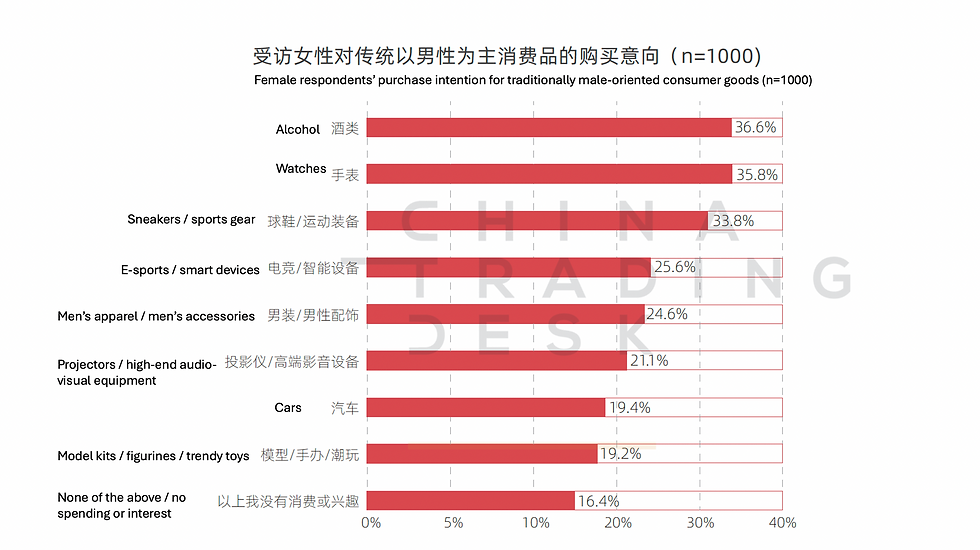

Women are also moving into traditionally male categories, with the highest purchase intent in alcohol (36.6%), watches (35.8%), and sports shoes and sports equipment (33.8%).

What this means for brands: speak to the planner, not just the buyer. Clarity, comparability, and future proof benefits matter.

What brands should do next

To build relevance with women aged 35 years and above, treat this cohort as a primary growth engine.

Five practical shifts:

Build trust before persuasion: evidence, transparency, service detail, responsible claims.

Design emotional value into the experience: comfort, privacy, calmness, competence.

Support long horizon planning: bundles, subscriptions, warranties, aftercare, guidance.

Use culture carefully: avoid stereotypes, speak to real pressure points, show respect.

Segment by life agenda, not only age: health anxiety, caregiving load, career phase, financial goals.

Two additional signals are especially actionable.

Women aged 35 to 44 contribute over 40% of paid users in vocational training and online education, showing strong willingness to invest in capability building. Strength and fitness culture is also mainstreaming: on Xiaohongshu, “fitness girl” and “lifting girl” topics saw 335% year on year growth in views, “muscle gain and body shaping” became a mainstream keyword, and fitness and training related notes increased 200%.

Brands that respond with practical, female friendly design and respectful storytelling can convert this energy into loyalty.

Conclusion

Women aged 35 years and above are disciplined decision makers optimising life quality through health, planning, and emotionally meaningful consumption. Their spending is not impulsive, it is intentional. Brands that combine credibility with emotional reassurance will earn not just transactions, but a durable role in everyday life.

Reach out to our team for more insights. We can help you turn market direction into a practical 2026 plan that aligns product, content, commerce, and seasonal moments.

Comments