AI-Native Marketing in China: How Xiaohongshu, Baidu, WeChat and Douyin Are Rebuilding the Funnel

From automated media buying to "answer engines" and always-on AI hosts, why brands must optimise for visibility, trust, and closed-loop conversion.

AI is quickly becoming the layer that decides what get seen and what converts across China's major platforms. From Xiaohongshu's 聚光 automation and "问一问" answer-style discovery, to Baidu's AI Search and Banfei closed-loop commerce modules, the funnel is shifting from manual optimisation and click-through journeys to automated delivery, summarised discovery, and in-app conversion.

TL; DR: What's changing

China's AI-native platforms are converging on three practical shifts for brands:

-

Distribution becomes more automated (bidding, targeting, budget shifts)

-

Discovery becomes more summarised (AI answers, lists, "best picks")

-

Conversion becomes more native and close-loop (in-app stores, agents, livestream automation)

The implication: winning brands won't just "get traffic." They'll earn inclusion inside answer modules, recommendation lists, and closed-loop purchase paths.

Platform 1: Xiaohongshu - AI turns seeding into a system, not a campaign

Xiaohongshu's direction is clear: reduce manual operations, increase creative throughput, and upgrade search from "find posts" to "get answers".

1) Juguang (聚光): intelligent delivery + creative optimisation at scale

-

Intelligent delivery (automated optimisation)

-

Shifts optimisation into the system layer with automated control plans (less manual bidding).

-

Automatically adjusts delivery to improve conversion efficiency.

-

Practical impact: frees teams to focus more on testing audiences, offers, and creative angles rather than bid micromanagement.

-

-

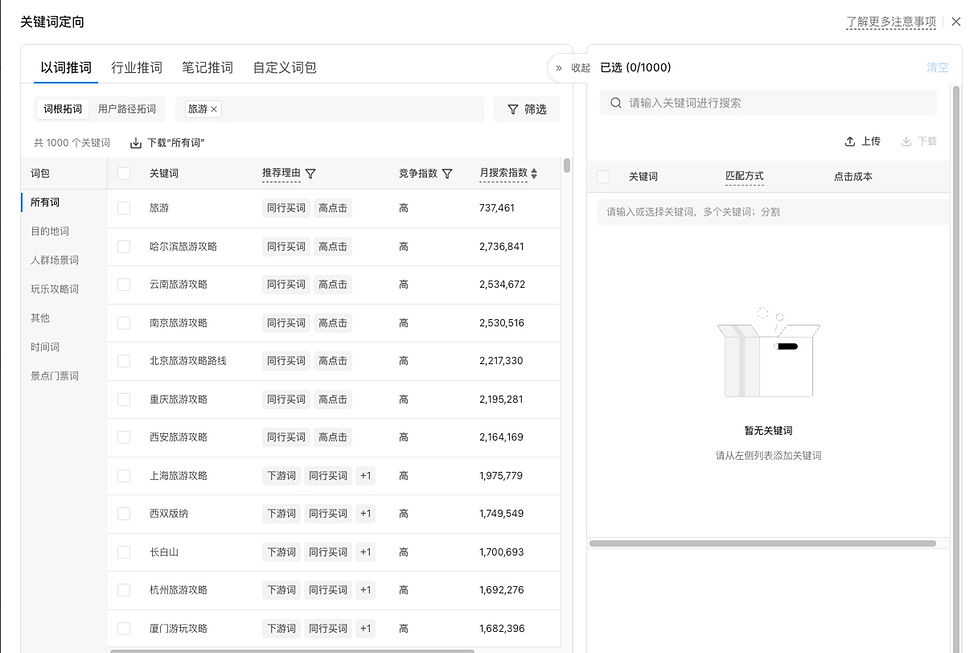

AI-assisted search marketing (keyword recommendations / "以词推词")

-

Recommends related keywords and tags them with reasons such as:

-

"Blue-ocen" (less competitive opportunities)

-

"Competitor-bought" (terms competitors are purchasing)

-

"Rising trend" (growing search interest)

-

"High CTR potential"

-

-

Practical impact: helps brands expand from one seed term into intent layers: problem → category → brand → SKU.

-

-

Creative optimisation: "Cover selection" (封面优选)

-

Uses an optimisation model to choose the cover image most likely to deliver the highest CTR.

-

The platform estimates CTR can increase by around 15% after optimisations.

-

Practical impact: brands should provide multiple strong cover options so the system has good candidates to test.

-

-

AI Note Tool (AI 一键生成笔记)

-

Generate as Xiaohongshu-style note (e.g. title + cover + main copy) based on product inputs and personalisation requirements.

-

Practical impact: enables faster, always-on content production and easier scaling for brands with many SKUs (with less manual writing/design).

-

2) "Wen Yi Wen" (问一问): the rise of answer optimisation

Instead of returning only a list of notes, Wen Yi Wen” summarises community content into structured answers and recommendation lists (e.g., “Top 10 must-buys”), often featuring highlights, pros/cons and usage tips. This matters because it captures users at the highest-intent moment, searching to decide what to buy, and positions a brand inside “the best answer”, not just inside the feed.

This creates a new form of Xiaohongshu SEO: brands must make content more summarisable, high relevance to queries, clear keyword structure, strong engagement signals, and authoritative publishing behaviour. This is how social proof is being “compressed” into a decision shortcut.

3) Lingxi (灵犀): SPU-level intelligence for "product-people-content" fit

Lingxi is positioned as an insights platform designed to help brands improve seeding effectiveness by connecting SPU signals + user behaviour + sentiment + content performance (across text/images/voice). It turns messy social feedback into structured decision inputs, helping brands identify what is growing, what converts, and why.

It supports brand teams across four practical use cases:

-

Opportunity discovery: spot rising keywords, demand scenarios, and content hotspots earlier.

-

SPU prioritisation: identify which products deserve budget and which “buying reasons” resonate most.

-

Audience lifecycle operations: manage users across awareness → interest → deep interest → purchase → share with clearer targeting logic.

-

Brand health tracking: monitor mindshare and word-of-mouth drivers, not just delivery metrics.

Platform 2: Baidu - from "search traffic" to "AI presence"

Baidu's AI shift changes the fundamental unit of visibility: search is becoming an answer engine rather than a link directory.

1) ERNIE + AI Search: zero-click discovery and authority-first optimisation

Baidu’s ERNIE-driven experience increasingly turns search from a list of links into AI-generated answers—sometimes with fewer clicks out to websites. That creates both a risk (traffic loss) and an opportunity (brand presence inside answers).

Key implications:

-

Optimise for conversational queries, not just short keywords. Users ask longer, scenario-based questions; your content must answer them clearly.

-

Build knowledge authority. Visibility shifts from keyword density to credibility signals: verifiable facts, strong entity information, and materials AI can confidently reuse.

-

Structure content so AI can read it. Clean formatting, consistent headings, and structured data approaches help machines interpret meaning.

-

Play inside Baidu’s ecosystem. Baidu-owned properties can receive preferential visibility, so brands may need an ecosystem content strategy rather than relying on external sites alone.

-

Update measurement. Track “AI presence” (mentions/citations/answer coverage) alongside clicks, because influence can happen without a visit.

2) Banfei (伴飞): AI-first commerce experiences inside Baidu

Banfei supports closed-loop conversion via modules such as AI Agents (always-on consultation), AI livestreaming, business accounts, and smart storefronts (including app and map presence to drive store visits).

For brands, the value is simple: shorter paths to conversion inside Baidu’s ecosystem, where discovery, consultation, and transaction can happen without leaving the platform.

Platform 3: WeChat - AI as the optimisation engine behind precision reach

WeChat's AI story is less about "one new feature" and more about upgrading the operating layer: segmentation, prediction, personalisation, and automated budget efficiency.

Key applications include:

-

AI-driven audience segmentation using behavioural signals to reach higher-converting users.

-

Predictive analytics estimating conversion likelihood, enabling oCPA automated bidding / automated conversion optimisation to shift budgets proactively.

-

Dynamic creative optimisation (DCO), assembling creative elements in real time to improve relevance.

-

Automated bidding and budget allocation to keep performance efficient as auctions change.

-

Continuous learning loops that iterate targeting, bids and creative recommendations in real time.

For brands running always-on campaigns, this strengthens WeChat’s role as a performance + CRM bridge, where creative relevance and targeting precision compound over time.

Platform 4: Douyin - AI turns content into a factory, and live commerce into an always-on channel

Douyin is pushing AI into both production and conversion: generate more content variants faster, and maintain continuous engagement across touchpoints.

1) AI-powered content production (via ecosystem tools such as Capcut/剪映)

AI-assisted editing, script generation, and avatar capabilities reduce creative cycle time and increase the number of variants brands can test, critical in a feed where iteration speed often determines efficiency.

2) AI Avatars: always-on selling across video, live, and chat

AI avatars can operate across short videos, livestreams, private messages and group chats, answering product questions, surfacing product links, and supporting upsell suggestions. Commercially, this makes “human coverage limits” less binding: brands can maintain engagement beyond operating hours and treat DMs as a conversion channel, not merely customer service.

3) Doubao inside Douyin+DOU: discovery and amplification become more automated

Doubao’s integration supports conversational assistance and search/discovery improvements within the Douyin experience. Meanwhile, DOU+ functions as an AI-assisted boosting tool to amplify high-performing content and drive interaction, followers or leads, making it easier to scale winners quickly.

The new optimisation playbook: win AI visibility, not only traffic

Across platforms, the goal is increasingly inclusion in AI-mediated surfaces (answers, lists, recommendations) and conversion inside ecosystems.

Here’s the practical playbook:

1) Optimise for AI visibility (not only clicks)

Track “answer inclusion,” list presence, and platform-native citations alongside traffic.

2) Write for summarisation

Use clear structure, explicit benefits, evidence, and query alignment to improve selection into AI answers and recommendation lists.

3) Scale creative like a system

Build modular assets (covers, hooks, demos, CTAs) so platforms can optimise combinations at speed.

4) Treat chat and live as conversion infrastructure

Always-on agents/avatars and guided consultation flows reduce drop-off in high-intent moments.

5) Build closed-loop measurement

Connect content → exposure → engagement → conversion within each ecosystem, then iterate weekly.

How China Trading Desk helps

AI Visibility & Answer Engine Optimisation (AEO)

We help brands increase inclusion and accuracy in AI answers, recommendation lists, and search-driven discovery across China's major platforms.

-

Query mapping + intent clustering across Xiaohongshu / Baidu / Douyin / WeChat search surfaces

-

“Summarisable content” templates (Q&A, comparisons, pros/cons, evidence blocks, structured headings) designed for AI-mediated discovery

Platform Growth Systems

We build repeatable systems that scale content, demand, and conversion inside each ecosystem.

-

Xiaohongshu seeding systems designed for “问一问” inclusion + conversion-ready content

-

Baidu AI presence strategy across Baidu-owned properties, AI answer surfaces, and commerce modules

-

WeChat performance + CRM compounding loop (segmentation, oCPA structure, creative system)

-

Douyin always-on creative factory + always-on live commerce and assisted chat conversion

Closed-Loop Measurement

We connect visibility to outcomes with a weekly optimisation cadence.

-

AI presence reporting (answer inclusion rate, query coverage, share of voice in answer modules)

-

Platform-native conversion paths + weekly iteration on budget, creative, and content performance

Engagement Pathway

A practical 12-week pathway to move from baseline → system → scale:

-

Audit (Weeks 1–2): query map, AI visibility baseline, content gap analysis, measurement plan

-

Build (Weeks 3–6): summarisable content system, creative modules, tracking and QA workflow

-

Scale (Weeks 7–12): always-on optimisation, budget/creative iteration, reporting and expansion of query coverage

Frequently Asked Questions (FAQs)

1) What is AI-native marketing in China?

AI-native marketing is the shift where AI increasingly governs distribution (automation and optimisation), discovery (summarised answers and recommendation lists), and conversion (closed-loop, in-app journeys). Brands win by being easy for platforms to recommend, summarise, and convert—often without a traditional click-through path.

2) What does "AI visibility" mean in practice, and how do you measure it?

AI visibility is your brand’s presence inside AI-mediated surfaces—answer modules, recommendation lists, summarised results, and conversational discovery—where users may decide without clicking through.

We typically track:

-

Query coverage: how many priority queries (brand/category/problem/competitor) surface your brand

-

Answer inclusion rate: how often your brand/products appear in AI answers or list-style modules

-

Share of voice in answers: prominence vs competitors across tracked queries

-

Mention quality: accuracy of positioning, key benefits, and compliant claims

-

Downstream signals: saves/collects, profile visits, store clicks, lead actions, add-to-cart (platform-dependent)

3) What should we measure if users don't click?

Track “AI presence” (mentions, answer inclusion, query coverage) alongside clicks, because influence can happen without a visit. You can then connect presence to outcomes through platform-native signals such as saves/collects, store actions, lead forms, and conversion events where available.

4) How long does it take to see results (30/60/90 days)?

You can usually expect measurable movement within 30–90 days, depending on category competition, starting presence, and content velocity.

A typical rollout:

-

Week 1-2: baseline audit, query map, content architecture, tracking setup

-

Days 15–45: publish and iterate core “summarisable” formats; start seeding + selective paid scaling

-

Days 45–90: expand query coverage, scale winners, and tighten conversion loops (store, lead, mini-program paths)

The fastest wins come from improving content structure + query alignment, then increasing output speed using repeatable templates.

5) What content formats are most "summarisable" for answer engines?

Answer engines perform best when content is structured, specific, and comparable. Formats that consistently work:

-

Q&A notes: “How to choose…?” “What to avoid…?”

-

Comparisons: A vs B vs C, product-to-product, brand-to-brand

-

Pros/cons + best-for: clear bullets, constraints, who it’s for

-

Checklists: “5 things to check before buying…”

-

Myth vs fact: clears confusion and builds authority

-

Scenario guides: “for sensitive skin,” “for business travel,” “for first-time users”

-

Evidence blocks: features/ingredients explained, usage steps, cautions (compliance-safe)

We typically build a content library that covers priority query clusters with repeatable templates.

6) What should brands optimise for on Xiaohongshu: saves, comments, searches, or conversions?

It depends on objective and category - but a practical hierarchy works well:

-

Early demand/education: optimise for saves/collects and high-quality comments (signals usefulness)

-

Mid-funnel consideration: optimise for search discovery (keyword alignment, “answerable” structure, topic clusters)

-

Lower-funnel intent: optimise for store clicks, inquiries, add-to-cart/purchase (where available), supported by clear CTAs and product clarity

In most cases, we design content to win both: high save-rate usefulness + a clear conversion path, then use paid to scale what's already working.

7) How do we optimise for Xiaohongshu 问一问?

"问一问" summarises content into answers and lists, so brands should publish content that’s easy to summarise: strong query relevance, clear structure, and credible signals AI can reuse (clean headings, comparisons, pros/cons, and consistent topic coverage).

8) Will Baidu AI Search reduce website traffic?

Baidu’s ERNIE-driven experience can produce more zero-click answers, which creates a traffic risk—but also an opportunity if your brand becomes present inside AI answers. The key shift is to optimise for presence and authority in answer surfaces, not only ranking and clicks.

9) Do we need a website for Baidu AI Search, or can we win inside Baidu's ecosystem?

You can win in both—but they serve different roles:

-

Baidu ecosystem presence (answers, Baidu-owned properties, in-platform conversion modules) captures users who prefer to stay inside Baidu experiences

-

Owned website supports deeper product detail, brand authority, and full-funnel measurement - especially for higher-consideration categories.

In practice, most brands perform best with a hybrid: ecosystem-first visibility + owned-site authority, aligned to the queries that matter most.

10) Why is WeChat still critical in an AI-native funnel?

WeChat's AI upgrades improve segmentation, predictive bidding (oCPA), creative relevance, and automated optimisation loops—making it a powerful bridge between performance media and CRM, especially when you’re building repeat purchase and lifecycle value.

11) How do Douyin AI avatars impact conversion?

AI avatars can extend selling coverage in live commerce and short-video scenarios by supporting longer operating hours and more consistent interaction. For many brands, the biggest value is making commerce more “always-on” and reducing the dependency on a single human host.

12) How do we choose between KOL/KOC seeding vs paid performance in an AI-native funnel?

Think of them as complementary:

-

KOC/KOL seeding builds credible, diverse content that strengthens trust and supports summarisation surfaces (especially "how to choose" and "best for X" queries)

-

Paid performance scales what proves conversion by amplifying validated themes into efficient acquisition

A common system:

-

Seed to create high-quality content coverage

-

Identify winners (topics, hooks, formats)

-

Use paid to scale winners + fill query gaps

13) How do you approach compliance and brand safety across platforms?

We build compliance into the operating system:

-

Claims governance: allowed claims, required qualifiers, forbidden language by category

-

Creative review workflow: pre-flight checks for ads + creator content (especially regulated categories)

-

Brand safety guardrails: creator criteria, sensitive topic exclusions, moderation rules

-

Documentation readiness: proof points/substantiation aligned with platform and category norms

If you’re in a regulated category (health, beauty, finance), we tailor formats to reduce risk while preserving performance.

14) What does China Trading Desk deliver in the first 2 weeks?

In the first 2 weeks, we focus on building clarity and momentum so execution is fast and measurable. Typical deliverables include:

-

AI visibility baseline across priority queries and platforms

-

Query map + intent clusters (brand/category/problem/competitor) and content gaps

-

Content architecture designed for summarisation + conversion

-

Creative test plan (variants, hypotheses, success metrics)

-

Tracking + reporting for visibility and conversion signals (platform-dependent)

-

90-day roadmap: publishing cadence, paid strategy, and iteration rhythm

Conclusion

China's major platforms are converging on one reality: the funnel is becoming automated, summarised, and closed-loop. Brands that win will prioritise trust, structure, and always-on conversion paths over legacy “traffic thinking.”

Reach out if you want a clear growth strategy across Xiaohongshu, Baidu, WeChat and Douyin — covering content structure, visibility levers, and conversion optimisation.