Chinese Foreign Travel Grew 11X in 2023 But Still Lags 59% Below 2019, Per China Trading Desk Report, Which Predicts 50% Rise in 2024

- China Trading Desk

- Jan 17, 2024

- 3 min read

China’s Gen-Y and Gen-Z grow increasingly fond of South Korea but show less interest in US–where travel remains 90% below 2019 numbers, per CTD’s 11,000-person Q4 survey. Young, educated women driving tourism rebound

SINGAPORE, January 17, 2024–Chinese tourism grew elevenfold in 2023 with 30.7 million people travelling to the top 20 destinations outside the People’s Republic of China, up from 2.67 million in 2022. However, foreign travel among Chinese last year remained 59% below pre-pandemic levels, according to China Trading Desk’s 4th Quarter China Outbound Travel Sentiment Survey–an 11,000-person study, which forecasts a 50% rise in travel this year and, also, shows significant generational and gender divides in evolving foreign travel patterns.

The number of Chinese tourists visiting 20 top foreign destinations in 2023 was 41% of their numbers in 2019, when 74.4 million left the country, according to China Trading Desk Founder Subramania Bhatt, who predicted 16 million (or 50%) more Chinese will travel abroad this year, bringing outbound travel in 2024 to 62% of pre-pandemic levels.

While travel to Macau, Singapore, the United Kingdom, the United Arab Emirates, Australia and Hong Kong rose above 50 percent of their 2019 levels, Chinese tourism to several other once-popular destinations remained far below pre-pandemic rates.

Notably, while more than 4.4 million Chinese visited the US in 2019, only 439,00 visited the country last year, up from 93,246 in 2022.

“In the Chinese press and on social media, the image of the United States is increasingly negative,” explained Mr. Bhatt. “Reports of mass shootings and videos of city streets overrun by homeless people have played a factor in keeping Chinese travel to the US low. Geopolitical tensions, the high cost of travel to the US and the unfavorable exchange rate haven’t helped either.”

China Trading Desk predicts more than 1.3 million Chinese will visit the United States in 2024, a threefold rise over 2023 levels but still 70% below 2019 travel figures.

Fears of nuclear contamination following the Fukushima disaster have played a role in dampening Chinese travel to Japan, per Mr. Bhatt. While nearly 10 million visited that country in 2019, only 3.7 million did in 2023.

Anxiety also suppressed Chinese travel to Thailand last year, but for different reasons. The popularity of Chinese-language movies depicting crime in Southeast Asia was a significant factor in depressing Chinese travel to Thailand and Cambodia. While more than 10 million Chinese visited Thailand in 2019, fewer than 4 million did last year.

China Trading Desk’s end-of-year survey–the world’s most comprehensive study of its kind–also revealed that a new profile of the average Chinese tourist is emerging.

Nearly 6 in 10 Chinese tourists in 2023 were female and more than half had bachelor’s degrees, per CTD, which also finds that 56% of Chinese travelers live in a Tier 1 city.

“The demographic profile of Chinese travellers shows notable changes,” China Trading Desk’s founder explained in the 4th quarter report. “While young, urban professionals from Tier 1 cities continue to dominate, there’s an intriguing rise in female travellers, highlighting a shift in the gender dynamics of Chinese foreign tourism. This development beckons marketers to tailor their strategies to engage this increasingly powerful consumer segment.”

Attracting China’s Gen-Y and Gen-Z tourists requires appealing to their desire for adventure, personal growth and social media-shareable experiences, said Mr. Bhatt, who emphasized that younger Chinese travellers also value eco-friendly, sustainable practices.

Europe, Singapore, Thailand, South Korea and Japan were the five most popular destinations for Chinese tourists in 2023; however, China Trading Desk research has found slight but significant variations across generations. For China’s Gen-Y and Gen-Z, South Korea is an increasingly popular choice while Thailand has become less popular. Conversely, China’s Gen-X prefers Thailand over South Korea. The popularity of South Korean cultural exports, particularly K-Pop and its movies and TV shows, are a large factor driving younger Chinese interest in travelling there, explained Mr. Bhatt.

China Trading Desk’s Travel Sentiment Survey also included the following findings:

63% of respondents who travelled abroad in 2023 had not travelled outside the country before.

35% plan to travel abroad within the next 6 months.

68% prefer to book less than one month in advance.

AirAsia, Singapore Airlines and United Airlines were the three most popular airlines for Chinese tourists travelling abroad.

53% of respondents planning to travel abroad plan to spend at least 25,000 RMB ($3,500 USD).

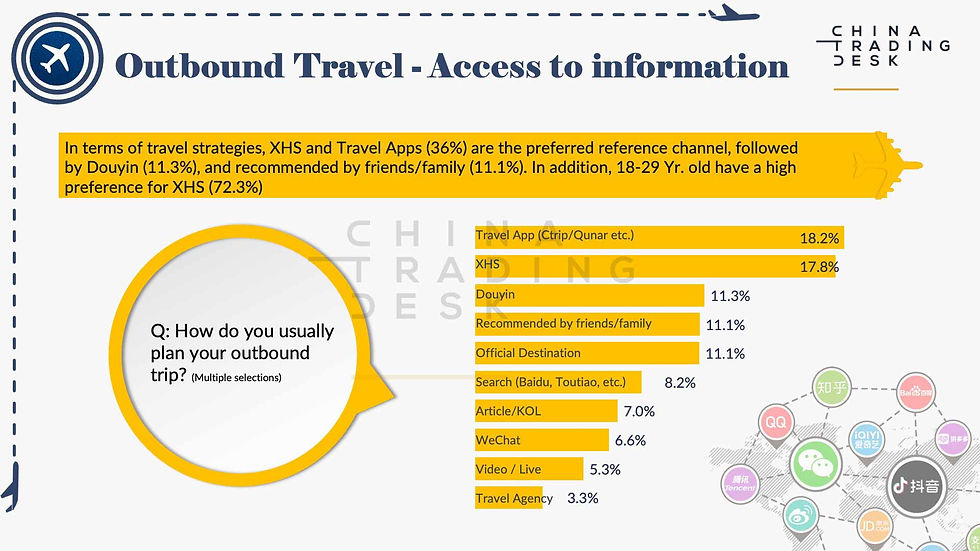

Travel App, Xiaohongshu, and Douyin were the three most popular sites used to buy flights and hotels.

Comments