China’s He Economy: How Male Consumers Are Reshaping Digital and Lifestyle Spending

- Alice

- Sep 12, 2025

- 3 min read

China’s male consumer market has entered a new stage of maturity, shaped by distinct behavioural patterns across age groups, digital ecosystems, and spending capacities. Male users now account for 6.34 billion monthly active users, representing 50.3% of the entire internet population, with average individual usage climbing to 168.3 hours per month, up from 157.4 hours a year earlier. This article explores the evolving consumption trends of Chinese men across different age groups, spending brackets, and digital behaviours, with all insights drawn from QuestMobile.

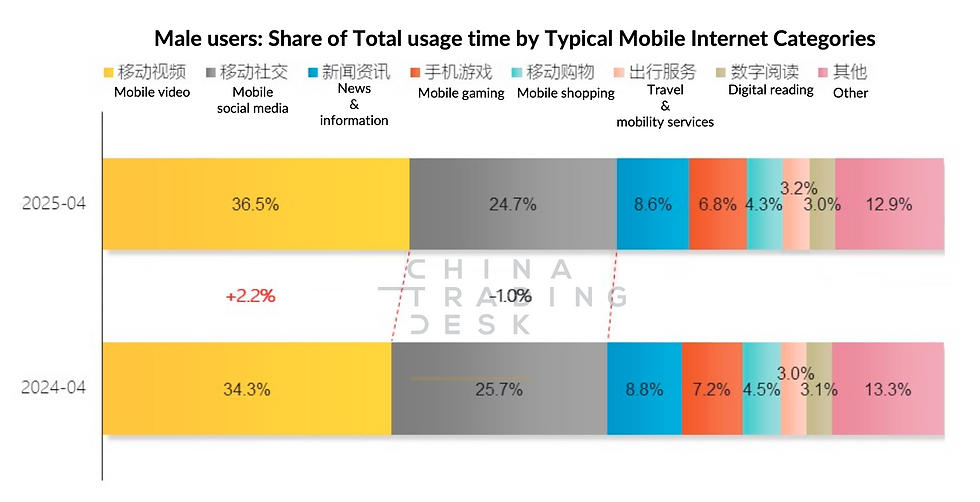

Time Spent and Sector Priorities

The structure of digital engagement highlights the dominance of video and social interaction. By April 2025, mobile video accounted for 36.5% of male users' total online time, rising by 2.2% year-on-year, while mobile social dropped slightly to 24.7%. Games and news together still command over 15% of usage, but the real shift lies in short video and live streaming content, which continue to capture disproportionate attention across all male demographics.

Demographic and Spending Power Shifts

The male user base reveals important structural changes. The proportion of users aged 51 and above increased to 23.3%, up 1.2% year-on-year, while younger groups below 30 have slightly contracted. This ageing skew is reshaping online consumption, with older men increasingly driving demand in categories such as short drama, e-commerce, and news. Spending power also exhibits divergence. Nearly 45% of men spend between RMB 1,000-1,999 monthly online, with incremental growth in the RMB 2,000-2,999 bracket (17.5%). High-spending groups above RMB 3,000 remain a smaller segment (7.9%) but are expanding. For brands, this points towards a dual strategy: maintaining broad-based accessibility for middle-tier spenders while cultivating premium offerings for affluent male users.

Segment Profiles

Men Under 30: Gaming and Lifestyle Pioneers

Younger men, totalling 198 million active users, are at the heart of China's gaming economy. They dominate across mobile, console, and PC titles, with Honor of Kings, Game for Peace, and Golden Shovel among the most popular titles. Importantly, their influence extends into culture, from e-sports viewership to fitness and skincare adoption. The so-called "appearance economy" is particularly vibrant here.

Men Aged 31-45: The Smart Consumption Core

Numbering 210 million users, this group represents China's new middle class and displays mature consumption habits. They are active investors in securities and wealth management, with apps such as Tonghuashun and Eastmoney leading usage. Smart living defines their preferences, with high penetration of connected car apps, financial platforms, and home technology ecosystems such as Xiaomi's Mi Home. Their spending patterns blend intelligent consumption and quality-oriented purchasing, reflecting both household responsibilities and aspirations for higher living standards.

Men Aged 46 and Above: Digital Silver Economy Drivers

The fastest-growing segment, with 226 million active users, men over 46 are emerging as powerful digital consumers. Their engagement with traditional casual games, news apps, and long-form video is extensive, but new habits are reshaping their profiles.

Platform and App Preferences

Across segments, preferences diverge significantly:

E-commerce: Taobao, Pinduoduo, and JD.com dominate overall, with JD seeing the fastest growth among older men (+15.3% year-on-year). Notably, Douyin Mall surged by over 1,600% among older male users, driven by its integration of live commerce.

Live Streaming: Among men over 46, 84.5% on Kuaishou and 82.5% on Douyin regularly watch live broadcasts, reflecting the deep entrenchment of social video in shopping journeys.

Media and News: Older men overwhelmingly engage with Today's Headlines, Tencent News, and Sina News, often with significantly longer average daily session times compared to younger cohorts.

Cultural and Behavioural Themes

Three cultural themes are particularly noteworthy:

The Rise of the Appearance Economy: From premium skincare collaborations (e.g., Estée Lauder × Manchester United) to domestic brands like Zuo Yan You Se, male beauty is firmly mainstream.

Short Drama as a Silver Content Engine: Older men are fuelling the popularity of narrative-driven micro-series, a format now central to Douyin and WeChat ecosystems.

Smart Consumption Meets Tradition: Middle-aged men combine financial discipline with aspirational purchases in premium alcohol, technology, and automobiles.

Conclusion

Male consumption in China is evolving rapidly, with video, commerce, and smart living ecosystems at its core. Younger men are setting cultural trends, middle-aged men are driving quality-conscious spending, and older men are emerging as influential digital consumers. Together, these shifts are redefining the consumer internet and creating new opportunities for brands. The key for businesses is to act decisively—by tailoring strategies to each segment, innovating in content and commerce, and building stronger digital touchpoints.

Is your brand ready to capture the loyalty of China’s male consumers? Contact us today to discover how we can help you turn these insights into actionable growth strategies.

Comments