Charting Hainan’s Retail Transformation: Insights from the 2025 White Paper

- Alice

- Aug 1, 2025

- 4 min read

Amid China’s consumption recovery and policy liberalisation, Hainan’s tourism retail sector is transforming through stronger infrastructure, growing international appeal, and consumer demand for premium, experience-led retail. The article presents a data-backed outlook on this shift—positioning Hainan as a strategic anchor for the future of global duty-free.

Drawing on insights from the 2025 White Paper on Hainan Free Trade Port Tourism Retail, jointly released by KPMG China and The Moodie Davitt Report (hereafter “the White Paper”), this article explores how Hainan is rapidly evolving into Asia’s next global tourism retail hub.

Global Recovery and Regional Competition: Hainan’s Place in the Sky

The global air travel recovery is unmistakable. In 2023, nearly 8.7 billion passengers travelled by air, according to ACI, marking a 30.6% increase year-on-year and recovering 94% of pre-pandemic levels. Asia-Pacific airports made significant gains: Guangzhou Baiyun surged back to 12th globally, while Incheon led growth with an astounding 213.8% YoY increase. Against this backdrop, China's aviation resurgence is solidifying its long-term role as the world’s second-largest air travel market—second only to the U.S., and ahead of India.

Hainan, strategically located and policy-backed, is primed to ride this tailwind. As a leading free trade port and China’s only island-wide duty-free zone, it offers a natural bridge between domestic consumption and international opportunity.

From Product to Emotion: The New Axis of Tourism Retail

The global retail paradigm is shifting from transactional to experiential. Nowhere is this more evident than in tourism retail, where the battle for consumer loyalty is increasingly fought through immersive experiences and emotional resonance. China’s consumers—especially Gen Z and affluent travellers—are demanding personalised, high-end, and emotionally enriching shopping journeys.

In Hainan, this has translated into innovative retail environments like Sanya International Duty-Free City, where five-sensory designs, interactive pop-ups, and tailored VIC services are redefining luxury engagement. Gone are the days of sterile duty-free halls; today’s competitive edge lies in curated storytelling, multi-sensory environments, and digital integration.

Policy and Platform: Building the Foundation for Sustainable Growth

Hainan’s rise has been fundamentally policy-enabled. Since 2011, duty-free sales have grown nineteenfold—from RMB 16 billion in 2012 to over RMB 309 billion in 2024. Key reforms such as the increase of personal shopping quotas, expanded product categories, and the simplification of post-purchase logistics (e.g., bonded warehouse delivery after departure) have underpinned this success.

2025 marks the critical customs closure milestone. With zero-tariff policies, simplified tax regimes, and the continuation of the “double-15” tax incentives through 2027, the island is rapidly becoming one of the most tax-efficient retail jurisdictions globally. When coupled with tourism visa liberalisation (e.g., 59-country visa-free policy, extended 240-hour transit visas), Hainan is increasingly accessible and appealing to international shoppers.

A Tale of Two Markets: Hainan vs. Korea

In comparing Hainan’s emerging market with Korea’s mature duty-free landscape, one sees both caution and opportunity. While Korea maintains scale and brand depth, Hainan is winning on flexibility, policy momentum, and domestic proximity. However, outbound Chinese tourism’s rebound and the attractiveness of weak-yen Japan have drawn some spending back abroad.

Notably, Hainan’s 2024 duty-free revenue dipped to RMB 309.4 billion, reflecting a shift in high-end spending offshore. Yet, the resilience in quarter-on-quarter growth—especially in Q1 and Q4—signals strong domestic demand. In contrast, Korea’s tax-free sector remains below pre-pandemic highs, and both markets face increasing pressure from price-sensitive e-commerce platforms and a rising domestic luxury scene.

Who Shops in Hainan? Profiling the New Retail Traveller

The Hainan traveller is not monolithic. Instead, four core personas emerge:

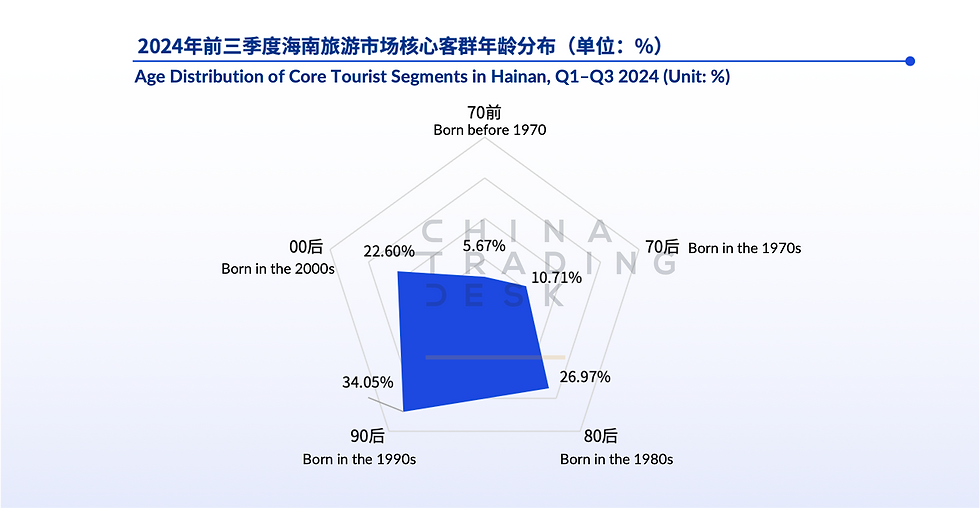

Young Explorers (Gen Z) – tech-savvy, content-driven, and seeking both fashion and social validation. They account for over 50% of Hainan's tourist base and are drawn to experiential offerings like concerts and themed pop-ups.

HNWI & VICs – loyal to premium brands, looking for exclusivity and seamlessness. High-end watch and jewellery sales remain stable despite macro headwinds.

Seasonal Migrants (银发族) – older “snowbird” tourists seeking health services and leisure in warm climates. These consumers favour value, service, and convenience.

First-Time Travellers – cautious, price-sensitive, and reliant on trusted platforms (e.g., Xiaohongshu). Retailers targeting this group must build trust through transparency and simplicity.

The Road Ahead: Experience Is the New Currency

Hainan’s long-term competitiveness depends not only on policy and infrastructure but on its ability to deliver retail experiences that rival global shopping capitals. “Price alone is not enough” is the prevailing sentiment—particularly as outbound travellers weigh Japan, Europe, and Korea against Hainan’s convenience and climate.

To compete, Hainan’s duty-free sector must double down on:

Digital innovation: QR code-led product journeys, influencer integration, and mobile-first UIs.

Premium service: personalisation, language access, and guided selling to engage novice and HNWI segments alike.

Cultural relevance: integrating Chinese heritage, local art, and storytelling to create a differentiated retail identity.

Conclusion: Hainan as Asia’s Next Retail Powerhouse

As we move through 2025 and toward customs closure, the island’s capacity to combine policy, infrastructure, digital innovation, and retail theatre will define its global standing. For brands and stakeholders, now is the moment to build presence, deepen loyalty, and co-create with the world’s most dynamic traveller base.

For strategic engagement or bespoke campaign design within Hainan’s dynamic tourism retail sector, please contact China Trading Desk.

Comments